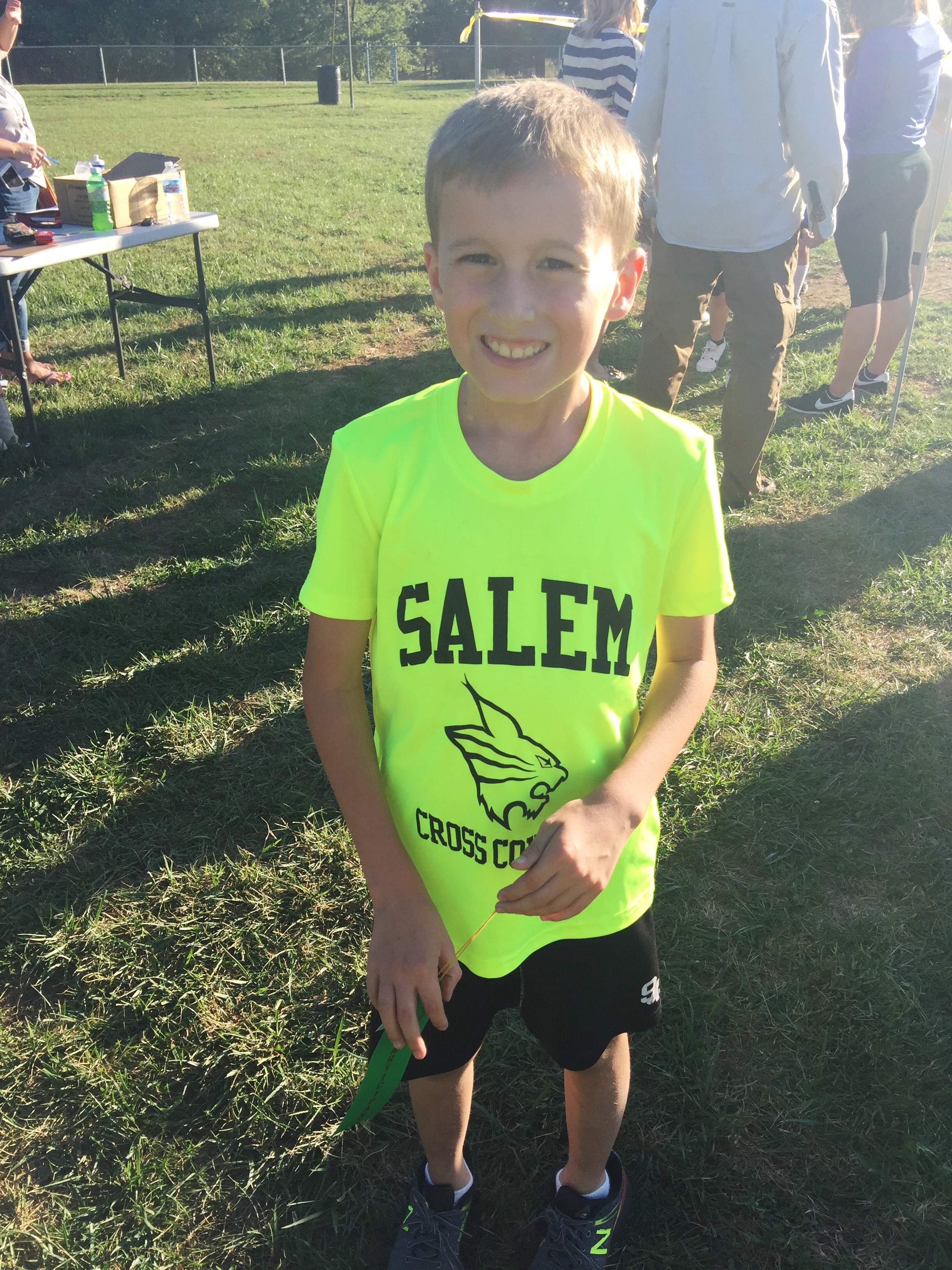

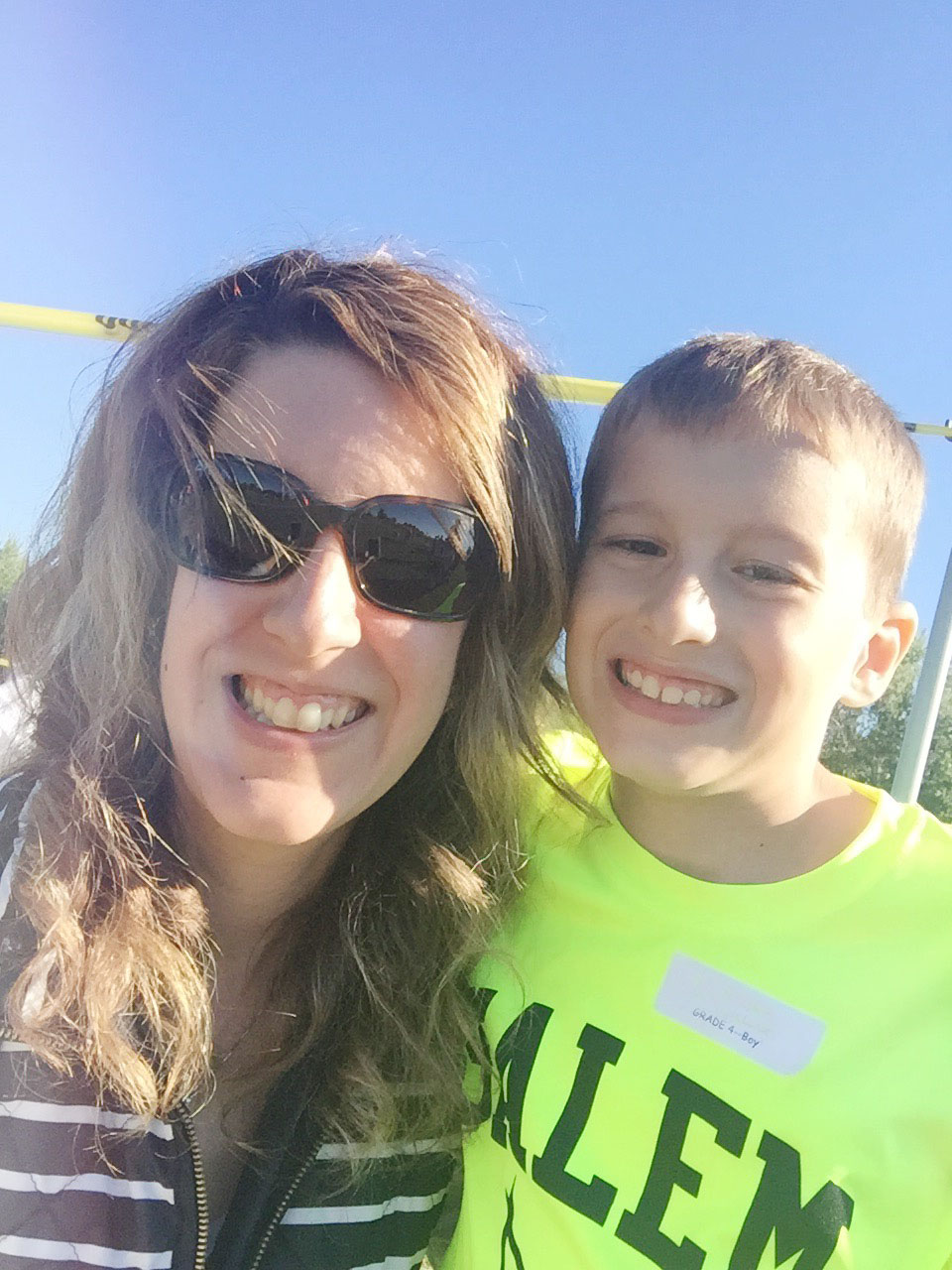

Every fall I start to worry as a parent of two kids with asthma. Fall has a lot of asthma triggers such as ragweed, mold (which is the highest in the fall), cold air (which restricts the airways), cold and flu viruses and even camp or bonfires. My kids enjoy doing normal activities and their doctor doesn’t restrict them unless their asthma is bothering them. Every fall my son has been in cross country and this year his sister has joined the team at school, too. It is said that running can actually help your asthma by strengthening your lungs, as long as you don’t have exercise-induced asthma.

Since my kids have asthma, I feel I have to be a little extra protective of them to avoid them needing to be on the oral steroids (which have unpleasant side effects), doctor visits, middle of the night ER visits (ugh!) and Autumn even had to stay a few days in the hospital due to her asthma. Before my son was officially diagnosed with asthma he had to take an ambulance to the ER due to a sudden asthma attack. Thankfully, his asthma has been controlled with daily meds, but my daughters asthma has still continued to be a challenge that we need to stay on top of each day.

To be honest, it is exhausting and completely stressful at times. You just really don’t know when the next attack will be… but, with my daughter one big warning sign is when she gets a lingering cough. We have had good asthma years and bad ones… you just really don’t know with asthma.

We have at least one or two ER visits a year with the kids asthma. If you count the hospital stay we had the one year, you will know that another stress with asthma is the unexpected hospital bills! Aflac Insurance offers Hospital Indemnity Insurance, which can help give you some relief with all of these extra hospital costs.

Did you know that:

- Hospital inpatient care accounts for nearly a third of U.S health care costs, and there’s no relief in sight: The average length of a hospital stay is 4.5 days at a cost of $10,400.

- Even if you have major medical insurance, it likely won’t be enough to cover every expense associated with a hospital stay, such as rising deductibles, copayments and out-of-pocket maximums. Hospital insurance pays cash for covered hospital stays, with optional benefits for diagnostic procedures, surgery, ambulance transport and more.

- You should consider the hospital indemnity insurance if you have a health plan with high deductibles.

Open Enrollment time for most U.S. companies is during the fall, this is a time when you can review your employer-sponsored benefit offerings and choose the health insurance policies that best meet your financial and health care needs.

Although selecting the right health care benefits may be one of the most important decisions you can make, an Aflac survey found that many workers do very little research to learn which plans and products work best for them. (In fact, 34% of employees spent 15 minutes or less researching their benefit options in 2014!)

Those that don’t set aside time to research their insurance options often end up with inadequate health care protection for themselves and their families. I have found this out the hard way by not having adequate insurance after several hospital stays for the kids asthma.

That’s why voluntary insurance helps, it allows you to select voluntary policies that best suit your own individual needs, as well as the needs of your children.

Be sure to research your benefits this Open Enrollment season and find the right voluntary policies to help keep your entire family protected. You can learn more about Aflac’s insurance plans by clicking HERE.

Aflac also offers an accident plan, cancer plan, hospital plan, critical illness plan, life insurance plan and a short term disability plan.

I was selected for this opportunity as a member of Clever Girls and the content and opinions expressed here are all my own.